Saturday, May 21, 2011

Who is the real Entrepreneur Magazine?

Wednesday, May 4, 2011

So you want to invest in Facebook.......is RenRen the next best thing?

Is Renren a buy in place of Facebook?

Tuesday, May 3, 2011

Orleans Hill Winery from Lodi CA

Orleans Hill Winery - Lodi, CA

I recently had the privilege of visiting with Donn Berdahl, co-owner of Orleans Hill, an organic and sulfite-free winery based in nearby Lodi, CA. After working as chief winemaker at Nevada City Winery as well as other California and French establishments, Orleans Hill was founded as a sole proprietorship in 1989 by Tony Norskog. Driven by very clear goals of producing a high quality product in strict adherence to USDA certified-organic requirements, business was slow to start in the early years, topping out at around 30,000 cases a year in 2003.

It was in late 2003 that Tony met Donn, and the pair realized they shared a common vision of winemaking, which led to the restructuring of the company as an S-Corporation and Donn signing on as co-owner in March of 2004. Orleans Hill is rather unique in that its two co-owners are its only full-time employees. Donn and Tony buy the grapes for their wines from local growers in the Central Valley, and then outsource most of the processes of production, leaving only the core of the business, the choosing and the fermenting of the grapes to be controlled directly by themselves.

The crushing operation is overseen by the founders at a third-party facility, and then mobile bottling units are hired for the bottling and packaging process. Distributors are then used, in partnerships with the bottling company, to move the product to other facilities off-site for storage before shipping to the wholesalers and then on to the retailers. This allows the business itself to run extremely lean, and through careful financial planning and reinvestment of the majority of the retained earnings, the pair have been able to maintain 100% control of the company without seeking any external financing.

Since Donn joined the operation in 2004, the complimentary skill sets have allowed Orleans Hill to ramp up to just over 160,000 cases a year in 2010, with distribution through nationwide stores such as Trader Joe's, and placement in 43 states; with more on the way. By maintaining no-nonsense, clear communication with its suppliers, contractors, distributors, wholesalers and retailers, Orleans Hill is able to facilitate this largely outsourced operation with the utmost level of quality control.

Orleans Hill is most famously the maker of "Our Daily Red", but also makes a Trader Joe's exclusive wine called "WELL REaD" under the Heartswork Winery brand, and a full line of wines under the Orleans Hill Winery brand including: Lodi Zinfandel, Lodi Syrah, Santa Maria Merlot, Cote Zero, Cabernet Sauvignon, and Alexandria. With demand picking up at increasing speeds, it remains to be seen if this model can be sustained forever, but for now, Tony and Donn are extremely happy with their business, their family lives, and the great wine they have been able to share with millions of Americans to date.

Check out the shelves of your local store for Tony and Donn's hard work, and check out their website for more information on their products!

http://www.ourdailyred.com/

Thursday, April 21, 2011

ZipCar IPO

It was nice to apply what we learned about initial public offerings to a company we read a case on – ZipCar. The article briefly introduces ZipCar’s business model, its board of directors (AOL co-founder Steve Case and former eBay CEO Meg Whitman), its investment groups (ie: Norwegian investment firm Smedvig Capital AS), and its individual investors that are selling the shares. Planning to trade on theb Nasdaq, Zipcar is aiming for a IPO value of “about $125 million at the midpoint of its expected price range of $14-$16 per share. Of that, the company expects proceeds of about $89 million, $46 million of which it plans to use to pay down debt.” 1 The offering is expected to price Wednesday night, with the stock to start trading Thursday, April 14, 2011. Overall, the article expects ZipCar Inc to “get a warm reception from Wall Street for its planned initial public offering”.

While I was waiting for Zipcar to premiere on the Nasdaq, I looked up the only investment group Christina Rexrode, AP Business writer, mentioned in the article, Smedvig Capital AS. Smedvig has 30 business in their portfolio with one company standing out – Streetcar, Ltd. Christina had mentioned Zipcar moving overseas last year (2010) by buying a UK rival Streetcar Ltd. So, I thought it was interesting how Zipcar partnered up with the same investment group that represented the company that Zipcar had acquired. Opening at $18 per share on April 14, 2011, “Zipcar closed at $28 per share, climbing up 60% in a day.” 2 Zipcar definitely performed better than the usual 10%-15% increase we learned in class. (Most definitely fared better than Knoll Furniture!) As Henry Blodget mentioned in his article in “Business Insider”, “Zipcar’s underwriters, Goldman Sachs and JP Morgan, just screwed the company and its shareholders to the tune of an astounding $50 million”. 2 In addition, an IPO ZipCar thought that charged a “7% IPO fee” on the $180 million the company raised (~13 million) in fact cost the company about $63 million”.

Wednesday, April 20, 2011

Is the Ivy League really killing innovation?

An interesting point raised is because established companies have become so risk averse, now when a creative mind attempts an innovation and fails, they innovator is subsequently fired for failing. Therefore, the managers who allow such attempts are reprimanded and unlikely to allow further attempts at innovating something new. The authors argue, instead of the innovator being fired, they should be given a raise and an atta-boy and told to continue their pursuit.

(we know prof. wadhwani is NOT one of those stifling ivy league types!!)

How the Ivy League Is Killing Innovation

Tuesday, March 29, 2011

A Pacific MBA's entrepreneurial accomplishments

Below is an overview of a Company which Pacific MBA student Faisal Al-Reshaid is involved:

Saracens Tournament (ST) is the first organized e-sports (Electronic Sports) tournament held in Kuwait. Founded by gamers with extensive experience in the industry, Saracens Tournament holds large annual and smaller monthly tournaments for all gamers to meet and compete with each other. Tournament winners are rewarded with many different prizes, but most importantly, the title of “Saracens Tournament Champion” which comes with a year’s supply of bragging rights!

The tournaments are located in Kuwait, but serve all competitive gamers around the world that enjoy playing console, hand-held, and PC games. Currently, the majority of Saracen’s Tournament participants come from the Middle East and North Africa.

The launch of Saracens in 2009 has been followed with numerous successes. The First Annual Tournament featured “Street Fighter 4” and was a huge success hosting over 400 spectators and participants. After the first tournament, one of the largest electronic retailers in Kuwait asked Saracens Tournament to host mini and annual tournaments, which they would sponsor to help promote their products. This was a great opportunity for ST to penetrate the market with minimal costs. At the moment, ST depends heavily on spectators and participants for generating revenue yet their success will create new sources of revenue when ST opens up its first hub (gaming café) in the near future.

Not only does ST plan on opening a hub for gamers to meet, practice, or simply challenge each other, but also plans on featuring multiple games during an annual tournament instead of one game. Even more, performances, exhibitions, and conferences will soon be part of the annual tournament to add more excitement and energy for the spectators! Finally, ST plans on supporting their champions to participate in other world-wide cyber games tournaments in order to provide their participants with continuous priceless rewards and also to gain exposure into the global e-sport market.

Below is a a link to the forum

http://www.topdark.com/vb/forumdisplay.php?f=7

Tuesday, March 22, 2011

Shark Tank is back!

eason includes 'guest' investors - Mark Cuban and Jeff Foxworthy. If for nothing else, the show is entertaining. However there are concepts to be learned from these investors. All the investors started as entrepreneurs so they discuss the complexities of business models, sustainable revenue streams, market size and potential and of course, RISK.

eason includes 'guest' investors - Mark Cuban and Jeff Foxworthy. If for nothing else, the show is entertaining. However there are concepts to be learned from these investors. All the investors started as entrepreneurs so they discuss the complexities of business models, sustainable revenue streams, market size and potential and of course, RISK.The show can be watched on ABC, check your local listings. It does appear the season premier is Friday March 25th around 8pm. Additionally, some episodes can be viewed at http://abc.go.com/shows/shark-tank/index

Tuesday, February 22, 2011

PRESIDENTIAL INFLUENCE ON SMALL BUSINESS

Overall, Professor Wadwhani does not think the Office of the President has much of an influence on the success of small businesses despite the efforts.

The article is a good read and worth the few minutes, even if you only search for his quotes on each presidents' efforts.

http://www.entrepreneur.com/article/218168

Wednesday, February 16, 2011

The Woz comes to Sacramento

Tickets will sell quickly for this event, so follow the link on how to get register.

http://www.sarta.org/go/sarta/news-events/events/sartas-2011-tech-index-celebration-luncheon/

Tuesday, February 15, 2011

Another skyhigh online company valuation

The creator of everyone's favorite online farm co-op, Zynga, Inc, is in talks with investors to raise around $250m. This would put Zynga's post-money valuation between $7b and $9b. Not only is that a lot of money, it also is a large increase in valuation from April, when it filed documents with the SEC valuing the Company around $4b. In less than a year this online game powerhouse has nearly doubled its valuation.

Zynga has been in growth mode, averaging one acquisition per month for the trailing twelve months.

A leading SF based fund manager, Larry Albukerk of EB Exchange Fund noted, "after Facebook, Zynga is the hottest company,"

For the complete article

http://online.wsj.com/article/SB10001424052748703515504576142693408473796.html?KEYWORDS=zynga

Thursday, February 10, 2011

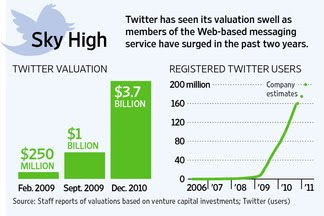

Is Twitter the next big tech acquisition?

With rumors circling around Twitter's acquisition by either Google or Facebook, how much is it actually worth?

A recent WSJ article claims the valuation to be closer to $10 billion!

Only time will tell what investors are actually willing to pay

To read the complete article

http://online.wsj.com/article/SB10001424052748703716904576134543029279426.html?mod=djemalertNEWS